Social Security Tips For Women

Not knowing these seven things could be costly for women

There are many misconceptions and gaps of knowledge about Social Security that can prove costly. This list will help clarify those misconceptions and fill in those gaps.

Your benefits are based on your highest 35 years of income.

Because so many women take on caregiving responsibilities, there are often gaps in their wage history. In fact, women average 10 years out of the workforce, and nearly two-thirds of part-time workers are women.1 Both of these conditions can negatively affect their Social Security benefit. Working a few extra years before retiring (or even in retirement) may help offset years they were out of the workforce.

If you file early, you lock in reduced benefits for life. '

A quarter of women file as soon as possible and roughly half file before full retirement age. Yet by waiting one more year, women could boost their benefit by an average of 8.6%.2

A spouse can claim their own benefit while waiting on the spousal benefit.

If your spouse’s wage history is significantly higher than your own, you’ll want to consider claiming spousal benefits, where you receive up to 50% of your spouse’s primary insurance amount after they begin claiming their own benefits. However, if your spouse plans to wait until age 70 to claim their benefit, your ability to claim spousal benefits must also wait. In the interim, you can claim your own benefits as early as your age 62 and begin receiving income. Then, when your spouse claims their benefit, you will be eligible for a spousal adjustment. Be aware, however, that if you claim your own benefit or your spousal benefit prior to full retirement age, you won’t receive the full 50% of your spouse’s benefit. Your spousal benefit will generally range from 35% to 50% of your spouse’s primary insurance amount, depending on when you file.

Your spouse’s or former spouse’s filing decision may impact both of you.

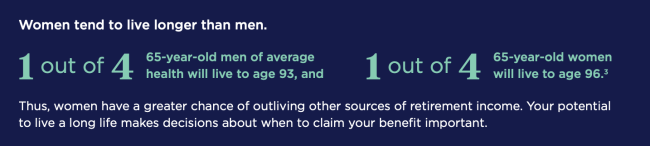

Because Social Security offers spousal, survivor and divorce benefits, and one spouse tends to have a higher benefit, the claiming decision for both spouses should be up to the one expected to live the longest.

You may be able to claim benefits on a former spouse’s record.

If you are divorced, you may qualify for benefits based on your ex-spouse’s record if:

- Your marriage lasted 10 years or longer

- You have not remarried

- You are at least age 62

- Your benefit is less than the benefit you would receive based on their work

- Your ex-spouse is entitled to Social Security retirement or disability benefits

If your spouse passes away, your Social Security income could drop by as much as 50%.

However, if both of you were receiving benefits, you can continue receiving the greater benefit of the two.