MARKET MONTH: FEBRUARY 2024

The Markets (as of market close February 29, 2024)

Stocks ended February on a high note as each of the benchmark indexes listed here closed up. The Nasdaq and the S&P 500 notched all-time highs, as tech shares, particularly those linked to AI, helped drive stocks. Inflation data released at the end of the month, was in line with expectations, which also supported stocks. February's gains marked the fourth straight month of advances for the S&P 500, the Dow, and the Nasdaq. For the year, the Nasdaq and the S&P 500 have risen about 7.0%, while the small caps of the Russell 2000 recouped losses from January.

Inflationary data showed price pressures remained marginally elevated, driven higher by rising prices for services. However, the rate of growth for the 12 months ended in February slowed, according to the personal consumption expenditures price index (see below), which rose 2.4%, nearing the 2.0% target set by the Federal Reserve. The U.S. economy, as measured by gross domestic product, continued to show strength in the fourth quarter of 2023 (see below).Consumer spending was solid reflecting greater confidence that inflation is coming down leading to increased spending power, especially where incomes are also rising.

The most recent inflation data showed prices inched higher in January for the second straight month. Both the Consumer Price Index (CPI) and the personal consumption expenditures price index increased in January. However, the 12-month rate for the CPI was unchanged for the year ended in January, while the PCE price index declined 0.2 percentage point.

Job growth vaulted higher in January (see below). In addition, both December and November were revised higher, adding 126,000 new jobs. Wages continued to rise, increasing 4.5% over the last 12 months. New unemployment claims decreased from a year ago, while total claims paid increased (see below).

With most of the reporting for fourth-quarter corporate earnings completed, the earnings growth rate for S&P 500 was 3.2%, marking the second straight quarter of year-over-year earnings growth, according to FactSet. The growth rate for revenue for the S&P 500 for the fourth quarter was 4.0%. While this is below both the five-year and the 10-year averages, growth in the fourth quarter marks the 13th consecutive quarter of revenue growth for the S&P 500. Eight of the 11 sectors reported revenue growth in the fourth quarter, with utilities, materials, and energy declining.

Sales of both new and existing homes increased in January, as inventory increased somewhat and mortgage rates decreased.

Industrial production ticked lower in January after no growth in December. Manufacturing declined 0.5% in January and 0.9% since January 2023. According to the latest survey from the S&P Global US Manufacturing Purchasing Managers' Index™, the manufacturing sector saw improvement in January for the first time since April 2023. The services sector saw business accelerate to a seven-month high in January.

All 11 market sectors ended January higher, led by industrials and materials. In fact, only real estate, communication services, utilities, and energy failed to advance at least 3.0%.

Bond yields gained as bond prices declined in January. Ten-year Treasury yields generally closed the month higher. The 2-year Treasury yield rose nearly 43.0 basis points to about 4.62% in February. The dollar inched higher against a basket of world currencies. Gold prices rode a topsy-turvy month, ultimately closing lower. Crude oil prices advanced in January on the heels of production cuts and shipping interruptions in the Middle East. The retail price of regular gasoline was $3.249 per gallon on February 26, $0.154 above the price a month earlier but $0.093 lower than a year ago.

Stock Market Indexes

| Market/Index | 2023 Close | Prior Month | As of February 29 | Monthly Change | YTD Change |

|---|---|---|---|---|---|

| DJIA | 37,689.54 | 38,150.30 | 38,996.39 | 2.22% | 3.47% |

| Nasdaq | 15,011.35 | 15,164.01 | 16,091.92 | 6.12% | 7.20% |

| S&P 500 | 4,769.83 | 4,845.65 | 5,096.27 | 5.17% | 6.84% |

| Russell 2000 | 2,027.07 | 1,947.34 | 2,054.84 | 5.52% | 1.37% |

| Global Dow | 4,355.28 | 4,375.95 | 4,508.75 | 3.03% | 3.52% |

| fed. funds target rate | 5.25%-5.50% | 5.25%-5.50% | 5.25%-5.50% | 0 bps | 0 bps |

| 10-year Treasuries | 3.86% | 3.96% | 4.25% | 29 bps | 39 bps |

| US Dollar-DXY | 101.39 | 103.55 | 104.13 | 0.56% | 2.70% |

| Crude Oil-CL=F | $71.30 | $75.76 | $78.32 | 3.38% | 9.85% |

| Gold-GC=F | $2,072.50 | $2,057.90 | $2,052.10 | -0.28% | -0.98% |

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark the performance of specific investments.

Latest Economic Reports

- Employment: Total employment increased by 353,000 in January following an upwardly revised December total of 333,000 new jobs. Employment trended up in professional and business services, health care, retail trade, and social assistance. Employment declined in the mining, quarrying, and oil and gas extraction industry. Employment increased by an average of 255,000 per month in 2023. Overall, in 2023 total employment was revised up by 359,000. In January, the unemployment rate was unchanged at 3.7% but was 0.3 percentage point higher than the rate a year earlier. The number of unemployed persons declined by 144,000 to 6.1 million but was 405,000 above the January 2023 figure. In January, the number of long-term unemployed (those jobless for 27 weeks or more), at 1.3 million, was little changed from December and accounted for 20.8% of all unemployed people. The labor force participation rate, at 62.5%, was unchanged from the December figure, while the employment-population ratio, at 60.2%, ticked up 0.1 percentage point. In January, average hourly earnings increased by $0.19, or 0.6%, to $34.55. Since January 2023, average hourly earnings rose by 4.5%. The average workweek decreased by 0.2 hour to 34.1 hours in January, and was down 0.5 hours over the last 12 months.

- There were 215,000 initial claims for unemployment insurance for the week ended February 24, 2024. During the same period, the total number of workers receiving unemployment insurance was 1,905,000. A year ago, there were 221,000 initial claims, while the total number of workers receiving unemployment insurance was 1,718,000.

- FOMC/interest rates: The Federal Open Market Committee did not meet in February after maintaining the target range for the federal funds rate at the current 5.25%-5.50% following its meeting in January.

- GDP/budget:The economy, as measured by gross domestic product, accelerated at an annualized rate of 3.2% in the fourth quarter, according to the second estimate. GDP increased 4.9% in the third quarter. Compared to the third quarter, personal consumption expenditures dipped from 3.1% to 3.0%. Fixed investment rose 2.5%, a 0.1 percentage point decline from the third quarter. Nonresidential fixed investment rose 1.0 percentage point to 2.4%, while residential fixed investment fell 3.8 percentage points to 2.9%. Exports increased from 5.4% to 6.4%. Imports decreased from 4.2% to 2.7%. Government spending decreased 1.6 percentage points to 4.2%. Consumer spending, as measured by the personal consumption expenditures index, rose 3.0% in the fourth quarter, down from 3.1% in the previous quarter. The personal consumption expenditures price index increased 1.8% in the fourth quarter, compared with an increase of 1.7% in the third quarter.

- January saw the federal budget deficit come in at $22.0 billion, down roughly $107.0 billion from the December 2023 deficit. The deficit for the first four months of fiscal year 2024, at $531.9 billion, is roughly $70.0 billion higher than the first four months of the previous fiscal year. So far in fiscal year 2024, total government receipts were $1.6 trillion ($1.5 trillion in 2023), while government outlays were $2.1 trillion through the first four months of fiscal year 2024, compared to $1.9 trillion over the same period in the previous fiscal year.

- Inflation/consumer spending: According to the latest personal income and outlays report, personal income rose 1.0% in January (0.3% in December), while disposable personal income increased 0.3% in January, unchanged from the prior month. The notable advance in personal income in January reflects increases in minimum wages in several states and the annual cost of living increase for Social Security recipients. Consumer spending advanced 0.2% in January after increasing 0.7% the previous month. Consumer prices climbed 0.3% in January after inching up 0.1% in December. Excluding food and energy (core prices), consumer prices rose 0.4% in January, 0.3 percentage point above the December advance. Consumer prices rose 2.4% since January 2023, 0.2 percentage point less than the advance for the 12 months ended in December. Core prices increased 2.8% over the same period, 0.1 percentage point lower than the year ended in December.

-

The Consumer Price Index rose 0.3% in January after ticking up 0.2% in December. Over the 12 months ended in January, the CPI rose 3.1%, down 0.3 percentage point from the period ended in December. Excluding food and energy prices, the CPI rose 0.4% in January, up 0.1 percentage point from the previous month, and 3.9% from January 2023, unchanged from the 12-month period ended in December. The January increase was the largest since September 2023. Prices for shelter, up 0.6%, continued to rise in January, contributing to over two-thirds of the monthly all items increase. Energy fell 0.9% over the month, due in large part to a 3.3% decrease in gasoline prices and a 4.5% drop in prices for fuel oil. Food prices increased 0.4% in January.

-

Prices that producers received for goods and services rose 0.3% in January after falling 0.1% in December. Producer prices increased 0.9% for the 12 months ended in January, down 0.1 percentage point from the 12 months ended in December. Producer prices less foods, energy, and trade services inched up 0.6% in January (0.2% in December), while prices excluding food and energy increased 0.5%. For the 12 months ended in January, prices less foods, energy, and trade services moved up 2.6%, a 0.1 percentage point increase over the 12 months ended in December. Prices less foods and energy increased 2.0% for the year ended in January (1.8% for the period ended in December). In January, prices for food fell 0.3% for the month and 3.6% for the year. Energy prices were down 1.7% in January.

- Housing: Sales of existing homes rose 3.1% in January from December. However, sales were down 1.7% from January 2023. The median existing-home price was $379,100 in January, lower than the December price of $381,400 but higher than the January 2023 price of $360,800. Unsold inventory of existing homes represented a 3.0-month supply at the current sales pace, down slightly from 3.1 months in December but above the 2.9-month supply in January 2023. Sales of existing single-family homes increased 3.4% in January but declined 1.4% for the year. The median existing single-family home price was $383,500 in January, down marginally from $385,800 in December but above the January 2023 price of $365,400. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.77% as of February 15, up from 6.64% the previous week and 6.32% one year ago.

- New single-family home sales increased in January, climbing 1.5% from December's total. Sales were up 1.8% from January 2023. The median sales price of new single-family houses sold in January was $420,700 ($413,100 in December). The January average sales price was $534,300 ($493,400 in December). The inventory of new single-family homes for sale in January represented a supply of 8.1 months at the current sales pace, down from 9.2 months in December.

- Manufacturing: Industrial production edged down 0.1% in January after being unchanged in the previous month. Manufacturing output declined 0.5% in January after ticking up 0.1% in December. Mining fell 2.3%, while utilities jumped 6.0% as demand for heating surged as milder December weather preceded colder temperatures in January. Over the past 12 months ended in January, total industrial production was identical to its year-earlier reading. For the 12 months ended in January, manufacturing decreased 0.9%, utilities increased 9.0%, while mining fell 1.2%.

- New orders for durable goods fell 6.1% in January following a 0.3% decrease in December. New orders for durable goods fell 0.8% since January 2023. Excluding transportation, new orders declined 0.3% in January. Excluding defense, new orders decreased 7.3%. New orders for transportation equipment dropped 16.2% in January, while new orders for nondefense aircraft and parts plunged 58.9%.

- Imports and exports: U.S. import prices advanced 0.8% in January following a 0.7% decline in the previous month. The January increase was the first one-month rise in import prices since September 2023 and the largest monthly advance since March 2022. Despite the January increase, U.S. import prices fell 1.3% over the past year and have not risen on a 12-month basis since January 2023. Prices for import fuel rose 1.2% in January following a 7.7% drop in December. Import fuel prices fell 10.0% from for the 12 months ended in January. Prices for nonfuel imports increased 0.7% in January after being unchanged in December. Nonfuel imports fell 0.3% since January 2023. Export prices advanced 0.8% in January after falling 0.7% in December. The January increase was the first monthly increase in export prices since September 2023. Higher nonagricultural export prices in January more than offset lower agricultural prices. Despite the January increase, U.S. export prices decreased 2.4% over the past 12 months.

- The international trade in goods deficit was $90.2 billion in January, up $2.3 billion, or 2.6%, from December. Exports of goods were $170.4 billion in January, 0.4$ billion, or 0.2%, less than in December. Imports of goods were $260.6 billion in January, $2.7 billion, or 1.1%, more than in December. Since January 2023, exports declined 2.9%, while imports fell 1.8%.

- The latest information on international trade in goods and services, released February 7, is for December and revealed that the goods and services trade deficit was $62.2 billion, up $0.3 billion from the November deficit. December exports were $258.2 billion, 1.5% more than November exports. December imports were $320.4 billion, 1.3% more than November imports. For 2023, the goods and services deficit decreased $177.8 billion, or 18.7%, from 2022. Exports increased $35.0 billion, or 1.2%. Imports decreased $142.7 billion, or 3.6%.

- International markets: Most countries continued to monitor inflationary pressures. Germany saw its rate of price increases slow to 2.5% in February, down from 2.9% in the previous month and more than market expectations. Elsewhere, Canada's annual inflation rate fell from 3.4% to 2.9%, the Eurozone saw inflation tick down from 2.9% to 2.8%, while the rate of inflation in the United Kingdom remained unchanged at 4.0%. Japan's consumer prices rose 2.2% for the 12 months ended in January, the slowest pace of growth since March 2022. For February, the STOXX Europe 600 Index rose 2.4%; the United Kingdom's FTSE gained 0.4%; Japan's Nikkei 225 Index gained 8.8%; and China's Shanghai Composite Index rose 8.8%.

- Consumer confidence: Consumer confidence declined in February after three consecutive months of increases. The Conference Board Consumer Confidence Index® decreased in February to 106.7, following a downwardly revised 110.9 reading in January. The Present Situation Index, based on consumers' assessment of current business and labor market conditions, fell back to 147.2 in February, down from 154.9 in the previous month. The Expectations Index, based on consumers' short-term outlook for income, business, and labor market conditions, slipped to 79.8 in February, down from a revised 81.5 in January.

Eye on the Month Ahead

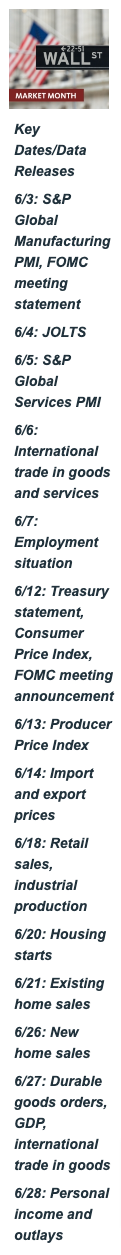

Economic data throughout the first two months of the year has been generally solid. However, the upward movement of inflation cooled any expectations of the Federal Reserve lowering interest rates when it meets in March.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 largest, publicly traded companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indexes listed are unmanaged and are not available for direct investment

IMPORTANT DISCLOSURES

Philippe E Berthoud and William E. Riquier offer Securities and Advisory Services through United Planners Financial Services, Member FINRA/SIPC. United Planners and The Retirement Financial Center are independent companies.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

This communication is strictly intended for individuals residing in the state(s) of AZ, CA, CO, CT, FL, GA, ME, MD, MA, MT, NV, NH, NJ, NY, VA and WA. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2024.